Home » Archives-7 » 2020-2021 Assessment and outlooks for Haulotte

2020 was singular in many different ways. How do you analyze the changes in the lifting equipment markets over this period?

Sébastien Martineau: Before the health crisis struck, we had already anticipated a downturn in 2020. The change in our markets is cyclic by nature and we were coming to the end of an upward cycle for various reasons, other than those relating to health. 2017, 2018 and 2019 had been extremely dynamic years. All in all, the outcome for the twelve months of 2020 is not so bad, despite this unprecedented crisis, which has accentuated this downward trend.

There was a very strong first quarter worldwide, in the same vein as the 2019 dynamic, after which everything came to an abrupt standstill in spring with the wide-spread propagation of COVID-19. Things then took off again vigorously in the summer. This momentum slowed down in the autumn but picked up strongly once more over the last two months of the year. It was more a stop-start year than a bad year, during which Haulotte rather consolidated its commercial position worldwide.

Are these trends true for all continents?

Stéphane Hubert: No. There are significant differences from one region or continent to another.

The markets in Asia and Oceania held up well and regained a lasting momentum from the spring onwards. This is particularly true of China, a gigantic market, the only country to have maintained positive growth during 2020 in equipment purchases. Notably, China became the leading market (in volume) for lifting equipment this year. To a lesser extent, Korea, Australia and Japan also held up well and recorded sustained, lasting demand.

The Middle-East (and Africa) zone has been facing a structural fall in investment for several years. The health crisis has only consolidated this drop.

The Europe zone (in the wide sense) stood up much better than could have been imagined. France, Germany, Spain, Italy and even Great Britain maintained high demand. It was the northern countries (Scandinavia, Netherlands) which came to a sudden stop.

Finally, after a normal first half-year, the North and South America zone was severely affected by the pandemic and still is today. Mexico, Brazil and Chile have entered a worrying economic phase.

How, more specifically, has the Haulotte group managed to “navigate” through this chaotic year?

Sébastien Martineau: Our results have obviously followed the market trends mentioned earlier. However, the global annual activity of the Haulotte group has held up well. Firstly, our worldwide presence through our 21 international subsidiaries, covering over one hundred markets, enabled our activity to be smoothed over the year, and significantly reduced the impact of the pandemic.

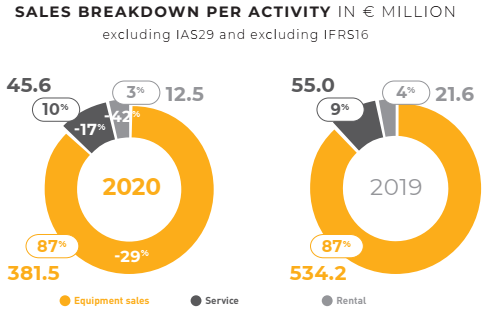

Haulotte achieved a turnover of €439.6M as compared to 610.8M in 2019, a drop of -27% between the two periods, and an operating profit for the period of +€11.9M. We kept our fixed costs under control, without restructuring or any impact on the Group’s strategic projects. Unfortunately exchange losses, mostly latent (i.e. without any impact on cash flow) significantly affected the net profit which stands at -€27.4M.

The size of the Haulotte group (2,000 employees), together with an agile method of governance deployed for many years, enabled us to navigate in a precise, responsive way, constantly adapting to the external conditions. We succeeded everywhere in regulating our production and our distribution networks, efficiently setting up health protocols and adapting the working methods and hours of each of our employees. This crisis has proved the soundness of Haulotte and our adaptability in the face of complex situations.

Stéphane Hubert: I would like to add that, despite this unprecedented period, we have launched several new products (Star 6 Crawler, HT 16 RTJ). We have continued to innovate tirelessly, illustrated by the launch of the PULSEO scissor lift range at the end of the year.

In September, we moved into our new headquarters, H3 (Haulotte Higher Headquarters).

What do you think the global market outlooks for lifting equipment are for 2021?

Stéphane Hubert: All over the world, the effects of the vaccination campaign announced and quickly implemented should start to be felt in the coming months. We are therefore expecting a first half-year that is still slow, but a much more active second half to the year.

From the point of view of world economic dynamics, the Asia/Pacific zone, with the Chinese market leading, but also Korea, Australia, Japan and the Europe zone to a lesser extent, should drive world demand for lifting equipment upwards. The year 2022 should be a stronger year, with an expected return to growth in North and South America.

From a regulatory point of view, the exponential multiplication of Low Emission Zones (LEZ), mainly in Europe and Asia, should also boost demand for non-polluting 100% electric equipment.

Specifically for Haulotte, what are the expected growth drivers this year?

Sébastien Martineau: The year promises plenty of news. In addition to business which has already restarted, we are building a new production unit at Changzhou (with an inauguration planned in 2022).

Moreover, Haulotte has already launched SIGMA 16, the electric articulated platform which is replacing the HA15 IP, and a Low Access range is scheduled for the end of the year.

Finally our global products/services offer is widening with the launch of SHERPAL, our new Fleet Management remote monitoring solution. This is accompanied by our full suite of services, which can all be found and accessed at a single web address: myhaulotte.com.

To conclude, 2021 and 2022 will be a significant turning point for Haulotte in the way we approach markets and our customers’ demand, ever more attentive to our customers’ needs, more flexible, more responsive and innovative, illustrating even more clearly our motto Let’s Dare Together!

A lire aussi

Training means progress

Haulotte France takes the skills of its Spare Parts Sales Teams to the next level